Explore why expatriates in Malaysia should consider private health insurance with Titan Financial Limited and Regency for Expats.

For expats living in Malaysia, health insurance is either provided by an employer or obtained privately. If you’re in the latter category and in the market for health insurance of your own, read on!

1. Who is Titan?

Titan Financial Limited (TFL) is a leading provider of comprehensive, independent financial planning solutions for individuals and corporations. With its presence in several countries, here in Malaysia, TFL is a fully registered and licensed Labuan company. Our goal is to capably address the diverse needs and aspirations of expats and international investors, wherever they may live.

2. Why is insurance coverage crucial for expatriates compared to individuals living in their home countries?

Expatriates often navigate unfamiliar healthcare systems and regulations, making insurance coverage vital. Having insurance provides them with a safety net, ensuring they can access quality healthcare and financial protection no matter where they are in the world. It offers peace of mind and security, allowing expatriates to focus on their work and personal lives without worrying about unexpected medical expenses or emergencies.

3. Why is private health insurance important in Malaysia?

While Malaysia boasts a decent public healthcare system, expatriates often prefer the flexibility and personalized care of private expat health insurance. Private insurance ensures access to a broader network of hospitals and specialists, shorter waiting times, and additional benefits like international medical evacuation and psychology benefits.

4. Why should expats not use local insurance plans?

Local plans may not always adequately meet expatriates’ unique needs, such as coverage during travel to other countries, language barriers, or familiarity with local healthcare systems. The local plans often have things like large co-pays, deductibles, and limitations to how much you can claim on a per-day basis. Titan Financial Services specializes in understanding expatriates’ requirements and tailoring insurance solutions for comprehensive coverage and support globally.

One of Titan Financial Service’s preferred partners which delivers exceptional service is an insurer called Regency for Expats

5. Why use Regency?

Regency for Expats offers competitive premiums with high-level benefits, focusing on personalized service and an extensive global network. With four coverage options, Regency ensures expatriates receive the support and protection they need worldwide, including access to quality healthcare providers, seamless claims processes, and additional benefits like psychology and fitness benefits.

One of the reasons we recommend Regency is because of firsthand experience with our clients’ claims being dealt with quickly and efficiently.

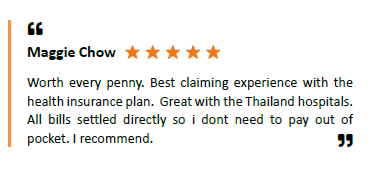

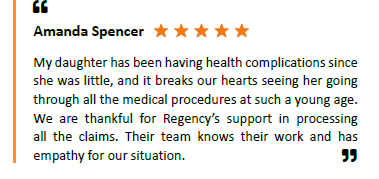

Here are just two of many five-star testimonials from Regency’s clients:

6. How do I make a claim?

There are two ways to make claims, depending on what you are claiming for. If you ever need to be admitted to hospital, please call Regency directly. They have multi-lingual claims teams who are all run by medical professionals and will reach out to the hospital after your call. If you are claiming for outpatient benefits, all you need to do is pay first, gather any medical reports, receipts, and the claim form then send it to the claims team. They reimburse into any bank account within 2-5 days.

7. What if my hospital does not recognize Regency?

Regency allows expatriates to choose any medical facility worldwide (excluding the United States), ensuring flexibility and accessibility. With swift payment arrangements with partner hospitals globally, expats can confidently seek treatment without concerns about insurance recognition.

8. Will my pre-existing condition be covered?

Regency for Expats understands that pre-existing conditions are a concern for many expatriates, but most insurance companies don’t cover pre-existing conditions anyway. What Regency says is they will accept 100% of the applicants, with no loadings, due to full pre-existing conditions exclusion underwriting. This means every application will be accepted on the standard terms and conditions – basically, if you have a condition, don’t worry, it’s not going to be covered by most insurers, but at least get insurance to cover you for everything else!

9. Where is Regency’s / Titan’s office located?

Regency for Expats operates regional offices worldwide, with a major hub in Bangkok. For local inquiries with TFL, you can call +603.2011 6644 or visit our office in Nihaal Business Centre in Damansara Heights.

10. How do I get a quote and sign up?

Getting started is simple! Scan the QR code below for more information on obtaining a quote and signing up for Regency for Expats insurance coverage.

"ExpatGo welcomes and encourages comments, input, and divergent opinions. However, we kindly request that you use suitable language in your comments, and refrain from any sort of personal attack, hate speech, or disparaging rhetoric. Comments not in line with this are subject to removal from the site. "