Burgernomics? Patty-power parity? It may have started out as a bit of a chuckle, but economists now take the Big Mac Index somewhat more seriously. How does Malaysia stack up?

The Big Mac Index, introduced by The Economist in 1986, serves as a lighthearted yet insightful tool for comparing the purchasing power parity of different currencies. Purchasing power parity (PPP) is an economic theory used to compare the relative value of currencies. It suggests that in the long run, exchange rates should adjust so that a basket of goods and services costs the same in different countries when priced in a common currency.

Essentially, PPP helps to measure the cost of living and inflation rates between countries by considering what a unit of currency can actually buy in terms of goods and services in each country. This concept is useful for comparing economic productivity and standards of living across nations.

THE BIG MAC INDEX

This clearly informal index is based on the price of a McDonald’s Big Mac in various countries, offering a tangible and relatable way to assess whether a currency is undervalued or overvalued against the U.S. dollar.

By examining the cost of this ubiquitous fast-food item, which is produced to nearly identical standards globally in well over 100 countries, economists can gain a snapshot of the relative cost of living and exchange rates between nations.

Though originally designed as a playful illustration of PPP, the Big Mac Index has increasingly become a popular reference in economic discussions, highlighting the often wide disparities in currency values and the practical implications of exchange rate fluctuations.

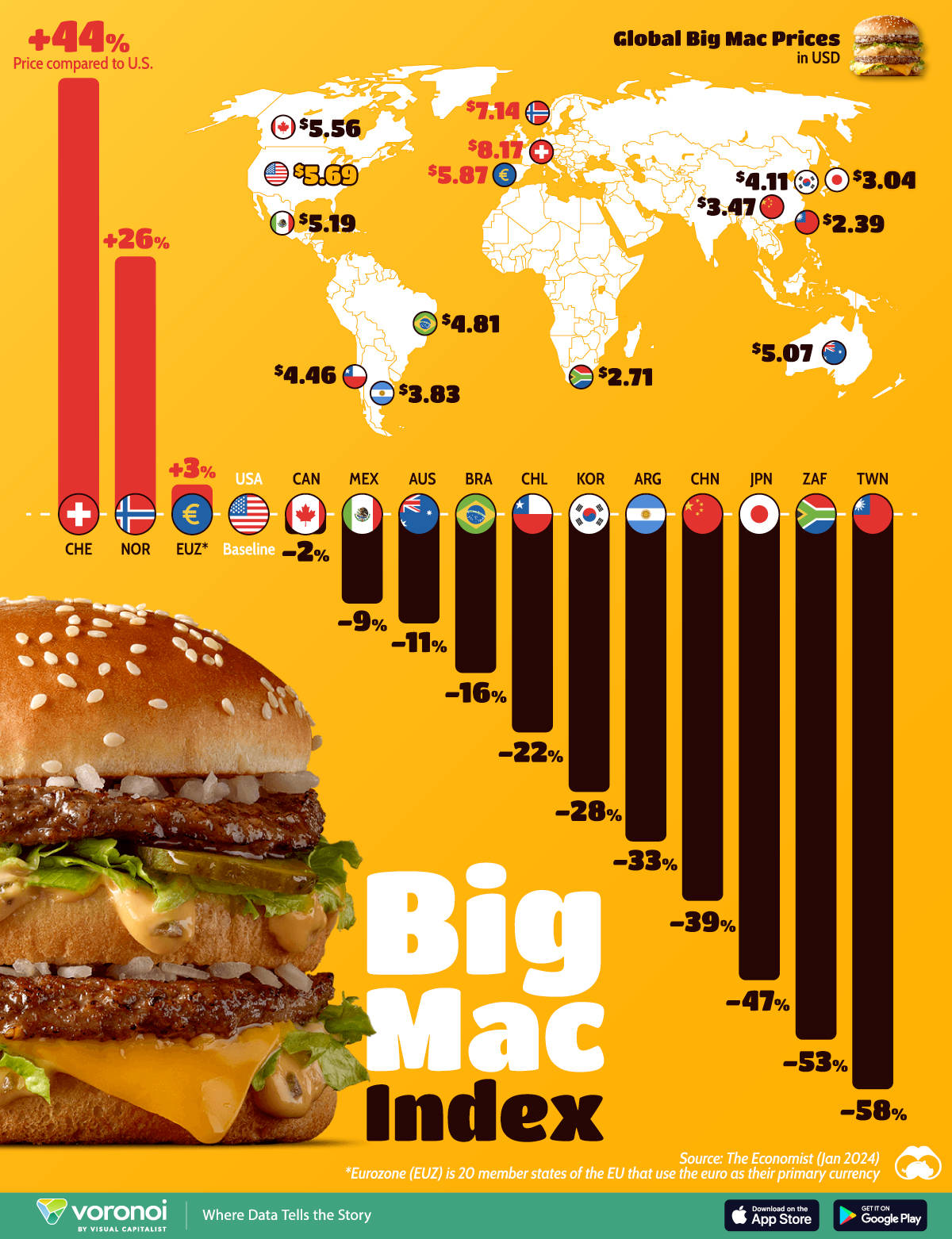

Earlier this year, Visual Capitalist mapped out the Big Mac Index across 13 countries, based on the prevailing dataset from The Economist. Malaysia wasn’t on their limited list, but we have the data that can be used for a comparison.

USING THE BIG MAC INDEX TO ASSESS CURRENCY STRENGTH AND VALUE

According to the article, we can use the price of Big Macs in other countries to see if a currency has more or less purchasing power than expected. This is done by taking the local price of a Big Mac (in local currency) and dividing it by the U.S. price of a Big Mac to calculate an implied exchange rate.

This implied exchange rate is then compared against the actual exchange rate between the two currencies to arrive at the index value; if the implied rate is higher than the actual rate, the local currency is ‘overvalued,’ and if it is lower, the local currency is ‘undervalued.’

Economists say that it’s worth noting that this measure is relatively simplistic and doesn’t take into account potentially significant economic factors like taxes, local production costs, and market barriers.

While it may not shock you that Big Macs cost a relative fortune in Norway and Switzerland, the fact that Asia is home to the world’s most undervalued currencies may indeed come as a surprise, thus giving those countries the lowest rankings on the Big Mac Index.

Taiwan, Japan, and China all have indices of around -40 or lower, while South Korea clocks in at -28.

So how about Malaysia?

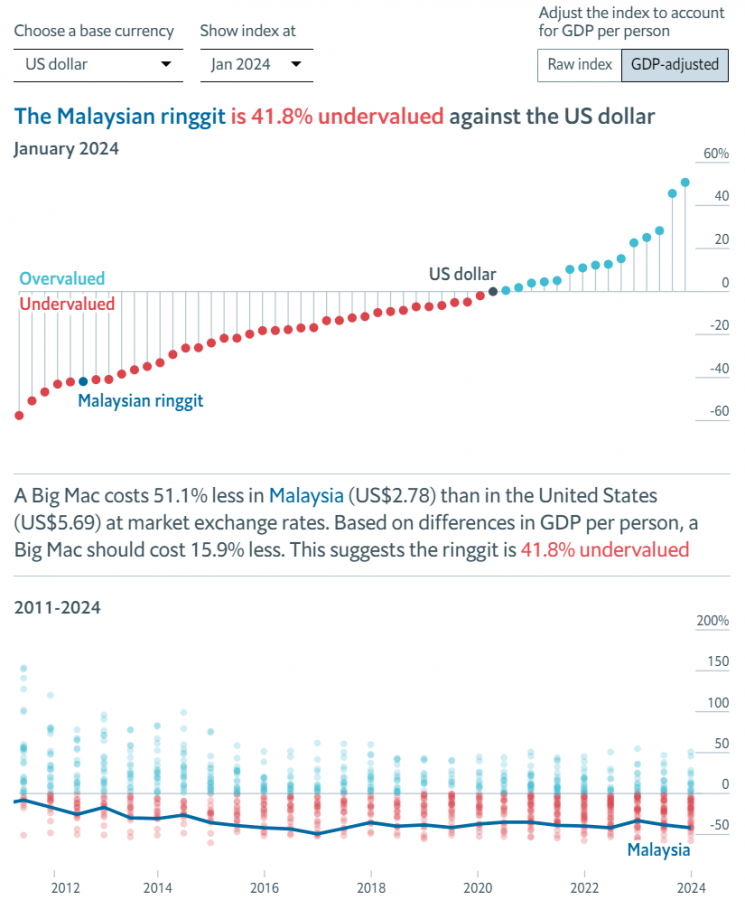

Well, as of early 2024, the average price of a Big Mac in Malaysia was approximately US$2.68 (or about RM12.60). This places Malaysia towards the lower end of the Big Mac Index, indicating that the Malaysian ringgit is undervalued relative to the dollar.

The relatively low price in Malaysia suggests that goods and services, in general, are cheaper compared to those in the United States, reflecting lower overall cost of living and wage levels in the country. For expats, who frequently cite the country’s low cost of living as one of its key attributes, this won’t be surprising in the least. In fact, the Big Mac Index has consistently shown the ringgit is undervalued over the past dozen years or so.

"ExpatGo welcomes and encourages comments, input, and divergent opinions. However, we kindly request that you use suitable language in your comments, and refrain from any sort of personal attack, hate speech, or disparaging rhetoric. Comments not in line with this are subject to removal from the site. "